StartUp India Seed Fund Scheme

Apply for Seed Fund

Unlock rapid growth opportunities and propel your startup towards success with essential support.

Ignite innovation and drive expansion as you leverage resources to fuel your venture's growth trajectory.

Flourish in the competitive landscape and expand your venture's horizons, empowering your journey to success.

About SISFS

SISFS aims to provide financial assistance to start-ups for proof of concept, prototype development, product trials, market-entry, and commercialization. This would enable these start-ups to graduate to a level where they will be able to raise investments from angel investors or venture capitalists or seek loans from commercial banks or financial institutions. To know more visit SISFS

Eligibility Criteria for Startups.

The startup must have a business idea to develop a product or a service with market fit, viable commercialization, and scope of scaling

A startup should be using technology in its core product or service, business model, distribution model, or methodology to solve the problem being targeted.

Preference would be given to startups creating innovative solutions in biotechnology, healthcare, and allied applications in industrial sectors.

A startup should not have received more than Rs 10 lakh of monetary support under any other Central or State Government scheme.

This does not include prize money from competitions and grand challenges, subsidized working space, founder monthly allowance, access to labs, or access to a prototyping facility

Shareholding by Indian promoters in the startup should be at least 51% at the time of application to the incubator for the scheme, as per the Companies Act, 2013 and SEBI (ICDR) Regulations, 2018

Any startup will not receive seed support more than once each as per provisions of para 8.1 (i) and 8.1 (ii) respectively

Funding For

- Validation of Proof of Concept, prototype development, or product trials

- Market Entry, Commercialization, or Scaling up

Quantum for Funding

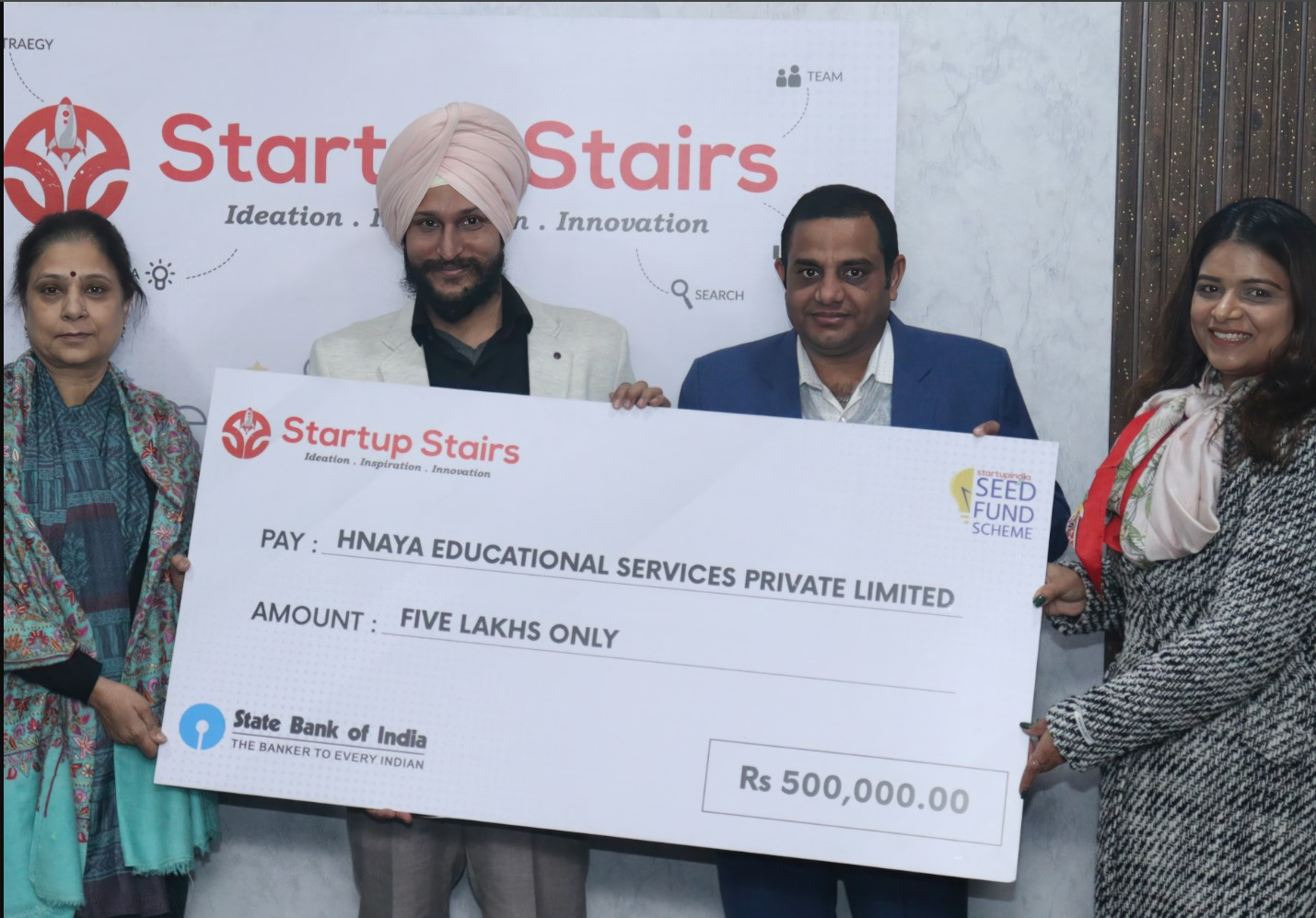

Up to Rs. 20 Lakhs as a grant for validation of Proof of Concept, prototype development, or product trials. The grant shall be disbursed in milestone-based installments.

Up to Rs. 50 Lakhs of investment for market entry, commercialization, or scaling up through convertible debentures or debt or debt-linked instruments

Visit to apply and select Startup Stairs as your first preference Apply Now!

Frequently asked Questions

Market size, what market gap is it filling, and does it solve a real-world problem?

Feasibility and reasonability of the technical claims, methodology used/ to be used for PoC and validation, roadmap for product development

USP of the technology, associated IP

Strength of the team, Technical and business expertise

Roadmap of money utilization

Any additional parameters considered appropriate by the incubator

Overall assessment

Customer demographics & the technology's effect on these, national importance (if any) USP of the technology, associated IP